Woolworths launches Woolworths Ventures

Getting corporate venturing right is not difficult, you just need to not fool yourself into believing that you are busy doing the right things.

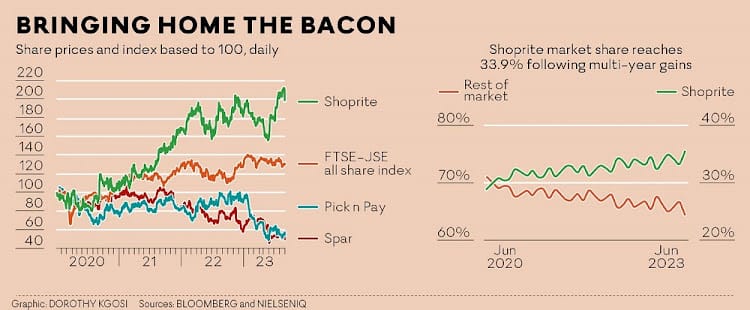

The engine of success powering Shoprite Checkers' astounding recent performance is an operation they call ShopriteX.

ShopriteX is - for want of a better term - a skunkworks unit, tasked to operate independently of the larger Shoprite Group with the intention of designing and developing new innovations (like Sixty60 and Xtra Savings) that deliver so-called outperformance. The big idea is not so much about delivering linear, year-on-year growth, but rather total market domination; thanks to the creation of outsized value for customers. And it works really, really well.

Setting up a smaller, more agile unit to drive these customer-focused projects is critical to their success. Corporate behemoths (obsessed with delivering value to shareholders) naturally kill anything that looks like 'risk' (ventures would be a very big red flag); purposefully housing innovation outside of 'the mess' is an important thing to do if being successful with your big aspirations is something you would like to achieve.

Under pressure to be more competitive in the category and perhaps thanks to the lessons offered in our book, Woolworths now have also set up an independent innovation-engine, which they have named... (rather unsurprisingly) Woolworths Ventures.

Before we go any further here - let's just take a moment to understand something clearly.

A 'venture' - in the context of business - is 'a high-risk, high-potential-return undertaking that carries with it a significant amount of uncertainty because it's a project that is aimed at creating a significant amount of new value where currently little to none exists.'

The attraction that corporate venturing offers is, that if successful, it gives the business an enormous advantage in a category; ensuring that the business is able to secure a dominant position accompanied by exponential financial returns over the long-term.

The risk associated with true venturing is worth it because the possible returns are so lucrative.

To outsiders a venture looks like a gamble. To shrewd strategists; it's all a matter of probability and plausibility based on conjecture.

Shoprite Checkers... investing significant amounts of time and money on fast grocery delivery (in a marketplace, where at the time, there was no entrenched consumer behaviour supporting the demand for fast grocery delivery)...is a venture. Toyota...going all-in on hybrid-technology when everyone else was saying that the future is EV...is a venture.

In stark contrast, the tone of what has been published about Woolworths Ventures is anything but welcoming of 'risk' in exchange for massive upside over the long-term.

According to Moneyweb:

A new standalone unit inside the sprawling retailer, Woolworths Ventures, will give the business the edge on the four high-growth adjacent categories to the core that it is targeting. These are pet, liquor, its smaller format clothing outlets known as W Edit, and food services. The last is a catch-all for its in-store coffee stands, standalone Now Now takeout, and W Café efforts.

...further...

The Woolworths CEO, Roy Bagattini, says the group’s “biggest opportunity is not in acquiring new customers; it is in growing the share of wallet of our existing customers”.

Really? Is that really the biggest growth opportunity?

In the Food business, he points to ‘VIP’ customers, who do the bulk of their grocery shopping at Woolies. This segment only comprises 10% of its base. For the remaining 90%, Bagattini says that for every additional 1% of their grocery spend they shift to Woolies, this translates into R1.5 billion in additional sales.

[BTW wishful paper-napkin mathematical calculations like this one for a business that is increasingly losing the remaining 90% of their customer base to a much more aggressive competitor, is not something you want to be sharing in public with a straight face.]

After reading this Moneyweb article, we're left with some questions.

So the idea behind Woolworths 'Ventures' and the Woolies definition of a 'strategic growth initiative' - is not to create brand new opportunities through the development of innovations that add significant value to customers, but rather to offer 'existing customers' more choice so that they spend more than they currently do on periphery categories outside of 'the core'?

Surely this is optimisation of the customer base, rather than a strategic growth initiative?

Why would you take on venture-type risk just to get a bit more from your existing market share?

Is Woolies indirectly admitting then that they have permanently lost the market share they once had to Checkers and now the only option left is to milk less loyal customers (the 90% not in the VIP camp) for a bit more? And what is this milking going to cost?

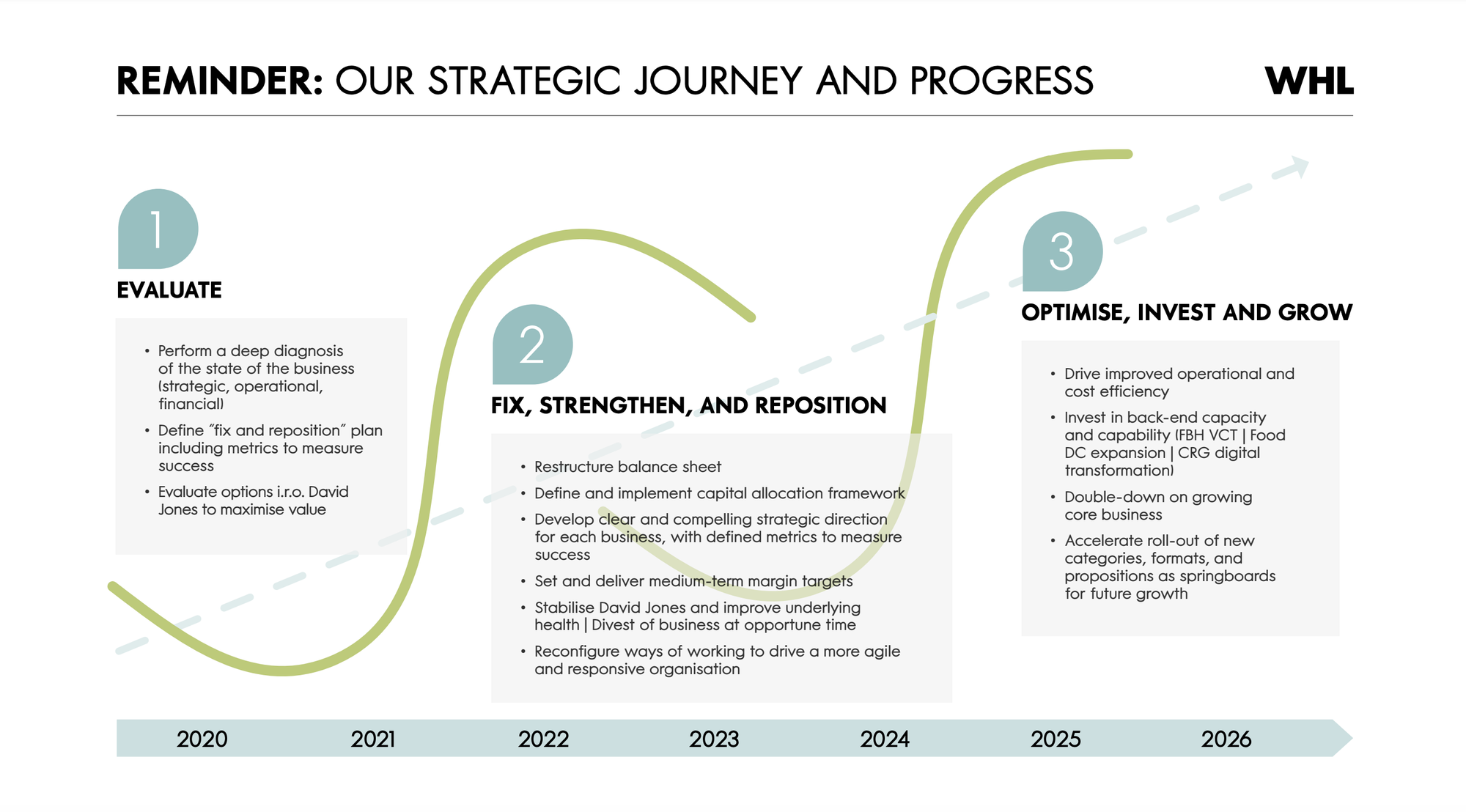

By all accounts this new unit does not appear (at this stage) to be aiming to deliver outperformance for the Group; granted, it might not have ever been set up to achieve this in any case.

They are not building an engine / asset / ecosystem / platform that is going to deliver the compounding returns that are needed. They're simply extracting a few projects into a new unit - out of the hair of busy, important managers who work for 'the core business'; who honestly don't see value in adding these sideline gigs to their already overburdened portfolios.

They are not creating something that you would possibly label as 'good' for customers. They're not solving a challenging problem that customers have; they're not building something new that will have a significantly positive impact on society as a whole.

As we've argued before, it's dangerous to label something as progressive and to mentally tick the box that you have 'innovation covered' when in reality that's not the case. Simply calling an intrapreneurial-unit within a big business a 'venture' doesn't mean that it will magically deliver the transformational outcomes that are generally associated with the term.

Strategy pageantry

Considering what's going on in the broader category and based on what has been published about this approach so far, this new unit will struggle to deliver on its mandate as a generator of strategic growth. This ain't no ShopriteX. And what's quite clear is that the leadership over at Woolies don't quite seem to 'get it'. Which is a shame because they sure earn enough to incentivise them to try a bit harder.

What this appears to be is a classic example of what we like to call strategy pageantry. It looks and sounds nice; it makes for a great show during a results presentation to investors, but lacks any kind of rigorous strategic nous to be of practical use.

There is no clear diagnosis of a viable, overlooked, future-opportunity that is to be exploited. There is no co-ordinated, interconnectedness between the various 'categories' that have been identified as a part of this unit's first foray into the realm of implementation. We can't honestly say that there is evidence of any reasonable strategic thinking in this whole presented idea.

There is nothing overtly strategic about rolling out different formats of a retail store you already operate. Or acquiring a market leader in a small adjacent category and then investing more into fortifying that position. Consolidating a growing collection of quick service food offerings under one banner to optimise your operations more effectively, really shouldn't be a project that only a small nimble, dedicated team is honestly able to deliver.

One doesn't get the sense that Woolworths are applying their significant weight to any key strategic leverage point that will yield for them untold prosperity.

All of these basics are awkwardly missing.

Getting corporate venturing right is not difficult, you just need to not fool yourself into believing that you are busy doing the right things.

A good start to doing strategy and venture building properly is to maybe have a casual chat to some people who have actually done this kind of work before. Get their valuable input. Ask them to help you check your own bias. Get some insights and advice from those who have the scars to prove that they have been there before.

If outperformance is the aspiration for this business, they are going to need a helluva lot more than 'the edge' that this approach will maybe deliver. The boys from Brackenfell are only getting started; and then of course there's the much-anticipated South African debut of the world's 3rd biggest brand (who just so happens to also be a retailer), which they can look forward to.

Einstein said: 'No problem can be solved from the same level of consciousness that created it'. Woolworths Ventures is the same old, tired rhetoric from a management team that are quite clearly lacking in imagination and creativity.

More: