Understanding the South African economic market trends 2024

Where do the opportunities for South African SMEs lie?

Without sinking into a swamp of technicalities, progressive economies that produce jobs and prosperity are those that are open, growing, are not concentrated (not dominated by monopoly players) and enable easy access for all participants.

On the other end of the continuum, conservative economies that produce inequality and stagnation are those filled with increasingly powerful bureaucracies (monopoly players), are plagued by a lack of innovation and shed jobs as efficiencies are favoured above the creation of new value.

Strategy & Innovation

Contact usIf you have to distill the biggest fear that keeps macroeconomists up at night - it would be the curse of the emergence of monopolies. Monopoly players are bad for economies because in their quest to deliver ROI for shareholders they kill jobs, slowly reduce the quality of what they sell to save money (which they can do because there is no effective competition in the marketplace) and make an economy less competitive. Because of this governments do everything in their power to discourage monopolist behaviour.

Which way is South Africa heading?

So in which direction is the South African economy heading? Are we enabling the conditions for a progressive economy or a conservative economy?

Yes, you guessed it. Along with the rest of the world, the South African economy is becoming more concentrated and anti-competitive across all industries.

South Africa has a highly concentrated economy

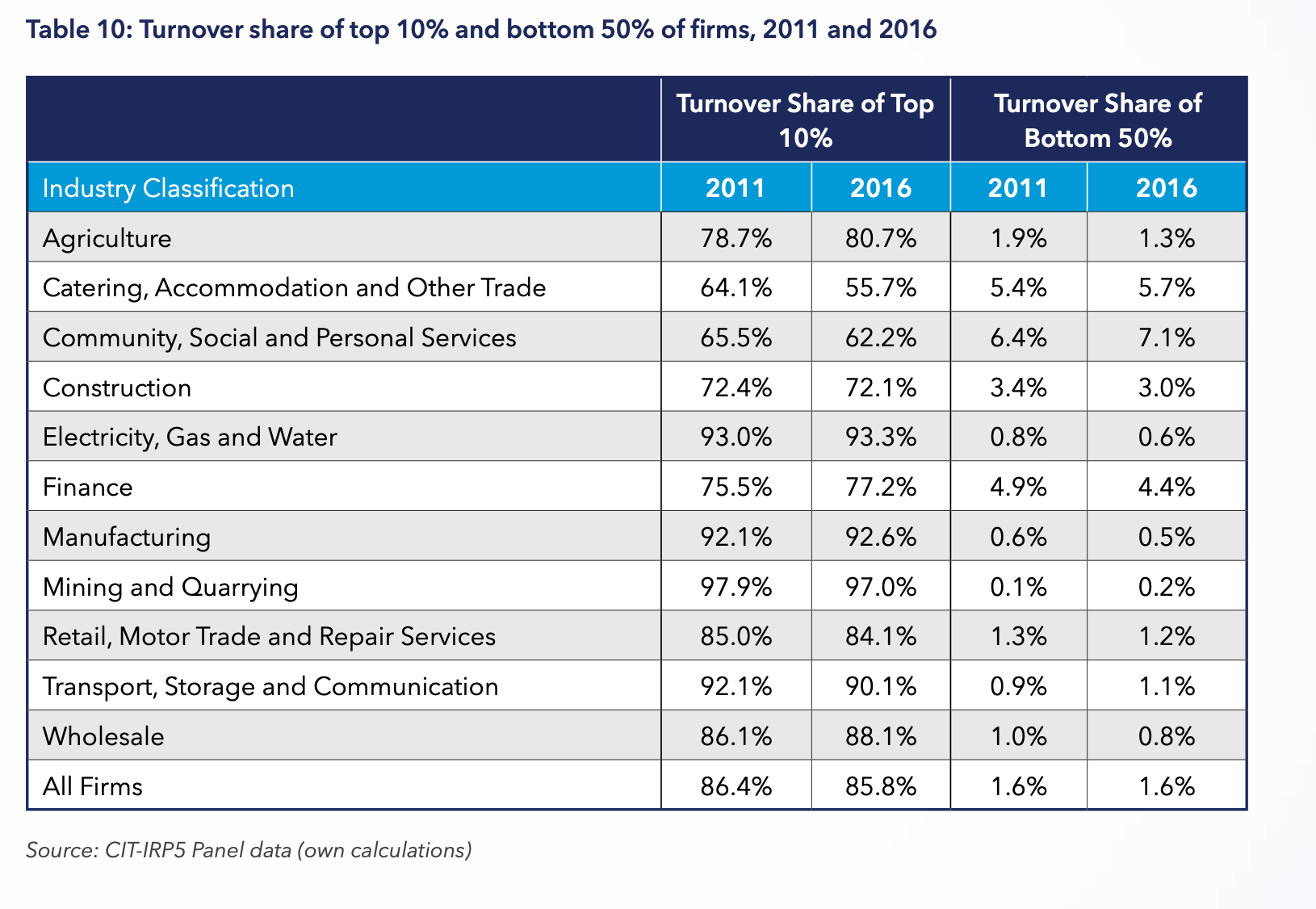

In a rather lengthy report published by the Competition Commission in 2021 it was found that the bottom 50% of companies in South Africa generate less than 1% of the country's entire turnover.

And the trend shows that the situation of concentration is getting worse...

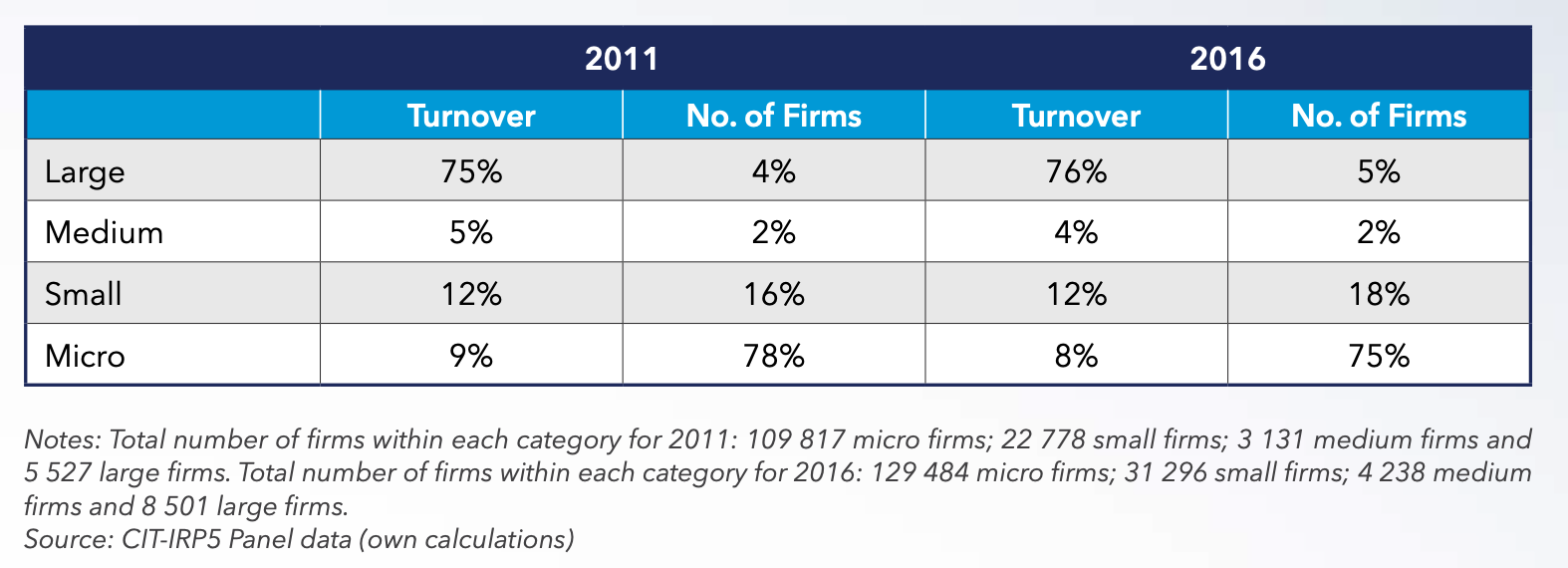

This table shows the percentage of turnover share taken by firms of various sizes between 2011 and 2016 as well as the number of firms that make up the overall market in each category.

Here's a look at the turnover share of the top 10% in relation to the bottom 50% in various categories between 2011 and 2016.

In South Africa, SME’s represent 95% of firms, 38% of employment, but only 24% of value by tax-paying firms, compared to OECD average of 50-60% of value.

What does this then mean?

Concentrated markets become stagnant because they do not enable themselves to be hotbeds of innovation. But dominant firms that don't innovate put themselves at great risk of disruption by faster moving players.

In all categories monopolies, or oligopolies, are forming which squeeze out smaller firms who play by the same rules, but present opportunities to those that can reconfigure the model to create an unfair advantage against the bigger player.

Everywhere you look in this report, there is opportunity to take on the monopolies that continue to form through the consistent application of innovation.

The future of South Africa will be created by the mavericks, the bold, the creative thinkers and doers, the innovators. Your country needs you now.

More: