Third Space CEO says they are selling a unique 'experience'

Third Space diagnosed the problem in the health club market to be that most gyms are structure to generate profit from scale and are just not exclusive enough for the 1% to be compelled to join

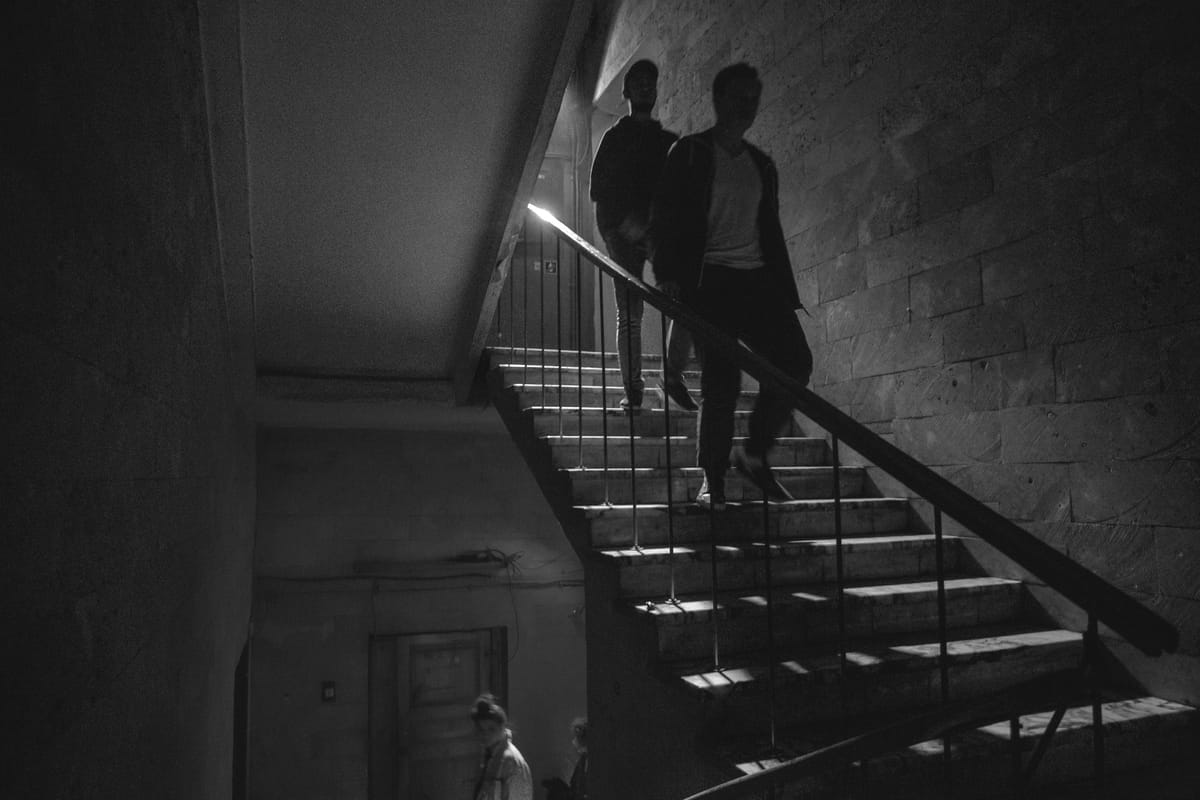

Third Space are luxury health clubs located in London that cost in the region of £350 (R8100) a month to belong to. They look incredible!

Far from simply offering the standard gym experience, Third Space's strategy is to niche the brand in the uber luxury segment of the market. What members end up buying then is not just a sweaty workout, but access to an exclusive inner city experience that separates the 'haves' from the 'have-nots'. [BTW - this kind of posh, exclusive member's club model has really taken off post-covid]

Health and fitness

Health and fitness (both physical and mental) continues to be a popular growth segment attracting a bewildering number of new businesses to the space. Standing out in the segment and attracting customers is a challenge, so founders need to be crystal clear about how they are going to compete in this crowded landscape.

Third Space have combined this trend with the growing demand for a luxury members-only experience to create their own position on the landscape - generating buzz and resulting in a lot of new sign-ups.

How small brands grow?

As is usually the case with a lot of successful startups that need to establish themselves in the marketplace with limited resources, the keys to success lies in a combination of (1) strategic focus, (2) contextual fit, (3) innovation, (4) creativity and the right kind of (5) capital partner relations.

Speaking to Monocle Magazine's Andrew Tuck recently, Third Space CEO, Colin Waggett, shares great insights into how the business has gone about building such a great brand in the last 20 years and giving themselves the ability to charge such a high premium.

Listen to the interview here:

How a business is funded makes a big difference

Something that's spoken about in this interview, that doesn't get enough attention normally, is funding: and in particular, how an organisation is funded.

In countless cases that we've experienced, funders that are not aligned with where the business finds itself (VCs / private equity / public shareholders / private shareholders) are often a significant cause of the downfall of a business.

If funders are not true partners and are just there to extract a financial return from their investment, this can place a terrible burden on a venture. Strategy should be focused on delivering value to customers, not skewed towards the demands of financiers.

In the case of Third Space, they are fortunate enough to have low levels of debt that are offered courtesy of a specialist travel and hospitality investor who acts as a true long-term partner for the business.

The one metric that really counts

Third Space pay very careful to one key metric of success above all others (and again this tends to be a measurement that in our experience is often paid lip service to).

Their Net Promotor Score (NPS) offers management an ongoing qualitative barometer as to how customers are enjoying the experience at the clubs and informs the team as to how well they are delivering on their promise.

What is the Net Promotor Score you ask?

NPS gauges how consistently a firm turns customers into advocates, by tracking and analyzing three segments: promoters, customers who are so pleased with their experience that they recommend your brand to others; passives, customers who feel they got what they paid for but nothing more and who are not loyal assets with lasting value; and detractors, customers who are disappointed with their experience and harm the firm’s growth and reputation. Promoters give a score of 9 or 10, passives a 7 or 8, and detractors a 6 or less. To calculate your firm’s overall Net Promoter Score, you subtract the percentage of your customers who are detractors from the percentage who are promoters.

The Third Space Strategy | Targeting the underserved 1%

In classic disruption, the 'disruptor' secures a position by offering value to an underserved, overlooked part of the marketplace (usually a mass market that wouldn't ordinarily be able to afford the existing offerings). Having secured a foothold in the market with a 'good-enough' offering, over time they then unlock profitability by taking increasing amounts of marketshare from the legacy players who struggle to compete at the lower price point.

In the case of Third Space, disruption happened in the opposite way.

They diagnosed the problem in the health club market to be that most gyms are structured to generate profits from scale and are just not exclusive enough for the 1% to be compelled to join (Investec is another example of this approach).

By targeting the 1% Third Space selected a small sub-category of the health club market that with limited resources they had a more viable chance of securing. They successfully chose a coherent set of relevant actions to make that vision a reality; and the result, so far, appears to be inline with what it is that they wanted.

Related: