How Lululemon plans to help the world feel well again

In this post we break down the published Lululemon strategy to get a better idea of how the brand plans to double revenue to $12.5B in just 5 years.

If you really love yoga, aren't shy to spend a bit of money on yourself and also love the idea of showing up to your next class wearing the very best training gear money can buy; then you're probably a Lululemon fan.

Even though the brand dominates its historical category in North America, Lululemon have far greater ambitions for the future of their business than just selling women's yoga clothing.

Based on their analysis and understanding of emerging consumer trends and how these might play out when projected further into the future, they see enticing new opportunities for the future of their business outside of their traditional marketing comfort zone. According to their internal business intelligence reports, health and wellbeing trends are converging strongly to create what has to be 'a new, golden-age of self-care'.

So in a highly-competitive global sportswear marketplace, how does this small, Canadian-brand plan to unlock the true potential of their enviable brand?

First let's wind back the clock, shall we?

Founded in 1998 (25 years ago) Lululemon Athletica Inc. is a Canadian brand that started off selling technically-superior yoga outfits to women.

Yoga in those days was less slick, manicured and fashionable than it is today, which was exactly the gapping hole that it's founder identified in the marketplace at that time. Back then there were no strong yoga wear brands - most people just sweated it out in an old t-shirt and some basic leggings. In fact you would have a hard time finding somebody who admitted to doing yoga back in 1998.

At first business was a relatively light-weight operation until it publicly listed in 2007 on Canadian and US exchanges.

The Lululemon brand has been, at a few times over the years, seen as somewhat controversial; most notably because of some wayward comments made by its founder, Chip Wilson, who at one point publicly said that the company’s signature Aspire leggings were not made for women “without a thigh gap” [Ouch].

The brand strategy was premised on the idea that people who do yoga sweat a lot - so they need exercise gear made of the highest quality fabric that can handle all the perspiration, while still keeping the wearer comfortable and most importantly, looking attractive.

Super girls

Mind you, the brand was not interested in servicing the needs of just anyone.

In line with the previous 'thigh gap' comment, Chip Wilson believed that to build a great brand, while spending as little money as possible, he needed to make clothing for a very tightly-defined customer segment; nicknamed 'super girls'.

“We focused in on just that 32-year-old professional woman who owned a condo, and traveled, and was fashionable, and athletic,” he said. “We didn’t care for the 33-year old, or the 31-year old. We just built for that one person.”

Investing in the development of the world's best synthetic fabrics was the strategic play made by Lululemon to crack the market and make a name for itself...and it worked really well.

The numbers

In 2016 Lululemon was generating an annual revenue of just over US$2billion.

That figure jumped up to over US$8billion in 2022 of which US$4.7billion is recorded as gross profit.

That's a 400% increase in revenue generation in just 7 years, which for a company that's been around for over two decades, is seriously impressive growth.

To put things into stark context - the company's net revenue for 2023 is estimated to be around $9.510 billion - that’s almost same annual turnover recorded for the whole of the Shoprite Checkers group (ZAR187 billion) - Africa's largest supermarket group.

And believe it or not - in this challenging economic environment - their audacious target for 2026 is US$12.5billion.

What's the problem?

If simply proposing a big future financial target were enough to make it so, then running a forward-orientated business would be simple, but after 25 years of operating the brand also drags with it some baggage from the past; a few barriers to growth must be identified and overcome.

Yes, just like every business Lululemon is facing some critical challenges to achieving their longer-term aspirations. These include:

- USA risk | One very clear issue is that the brand is highly concentrated in North America. Most of its retail outlets are in the USA and after 25 years of successful trading in this market, it has pretty much secured all of its total addressable market [TAM] for the foreseeable future. The US then doesn't offer the existing iteration of Lululemon much growth potential.

- Brand | Outside of North America - and ignoring the female segment in which they are strong - the brand still has some way to go before it can successfully compete for awareness with the likes of Nike or Adidas.

- Yoga | The brand is associated with yoga...and nothing else. Changing that is risky (there is the potential to lose credibility which yogis), takes time and money and puts the company's focus in lots of new areas rather than on its core area of strength.

What's the strategy?

How exactly does Lululemon plan to overcome their significant challenges and achieve their lofty financial desires? Let's take a closer look.

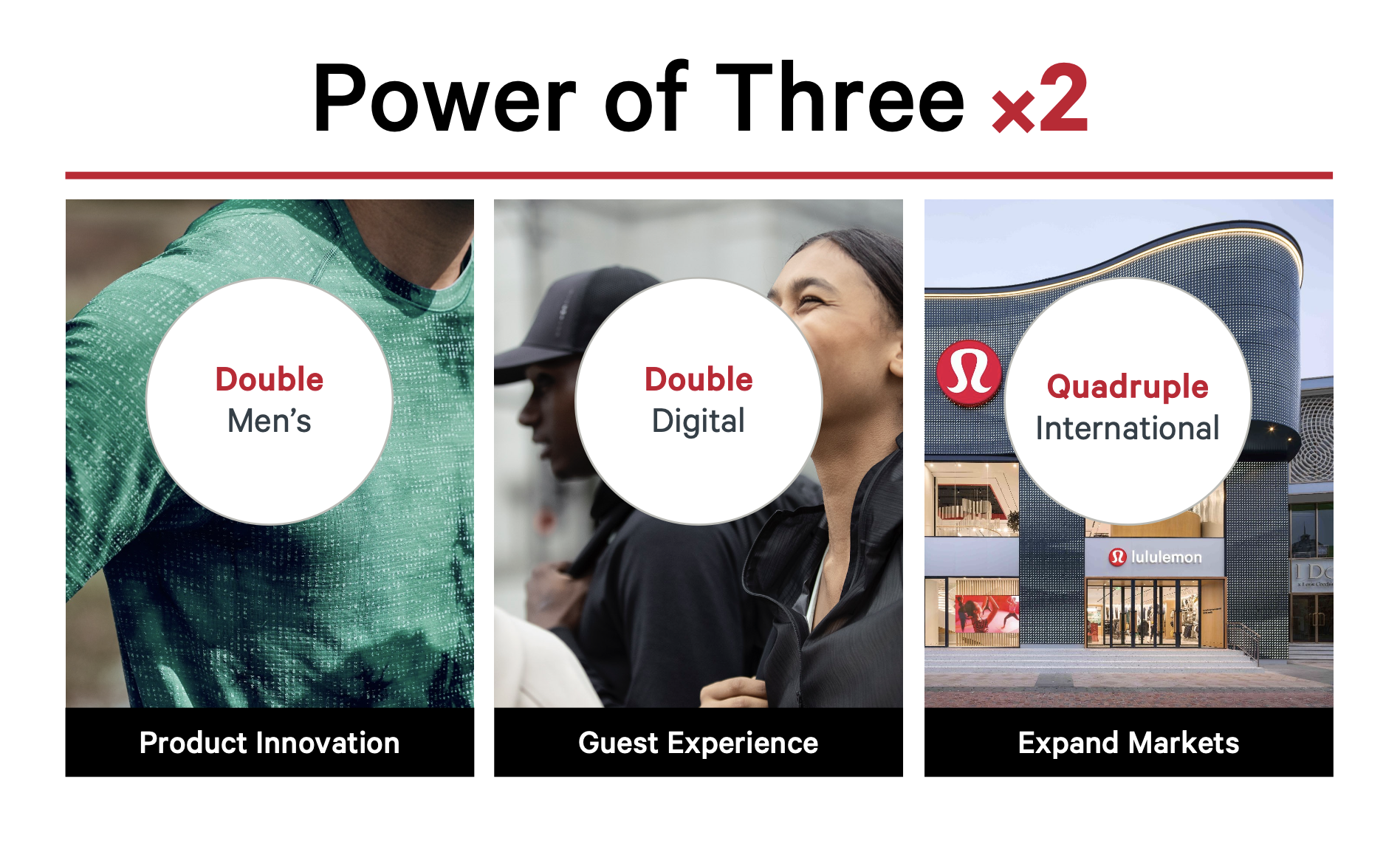

Like all good strategies, the Lululemon strategy has a catchy name; 'Three x 2' - a clever way of saying that the business is collectively focusing on three key strategic leverage points to achieve a doubling of their revenue. Financial targets alone are obviously far too shallow to be useful as a effective strategic 'north star'.

The three key areas of focus are to double the size (1) men's and (2) digital and grow their (3) international footprint by four times its recorded 2022 size.

To achieve their larger men's wear goal the business has chosen to leverage a greater urgency on their product innovation process.

The approach is to coordinate organisational efforts in five areas:

- Innovate new products (using the core strength of quality fabrics) to address male customer's unique needs traditionally overlooked in their historical focus on women.

- Appeal to those enjoying 'sweating activities' that go beyond yoga.

- Find and market the hell out of hit products. By picking product winners and driving their growth hard, you are able to better build the overall brand appeal in new markets and segments.

- Create new products for other clearly defined sporting categories like running, weight lifting, swimming etc.

- Invent radical new fabrics for all of these new products that are so ridiculously good that they literally kill the consumer demand for competing products in these new categories.

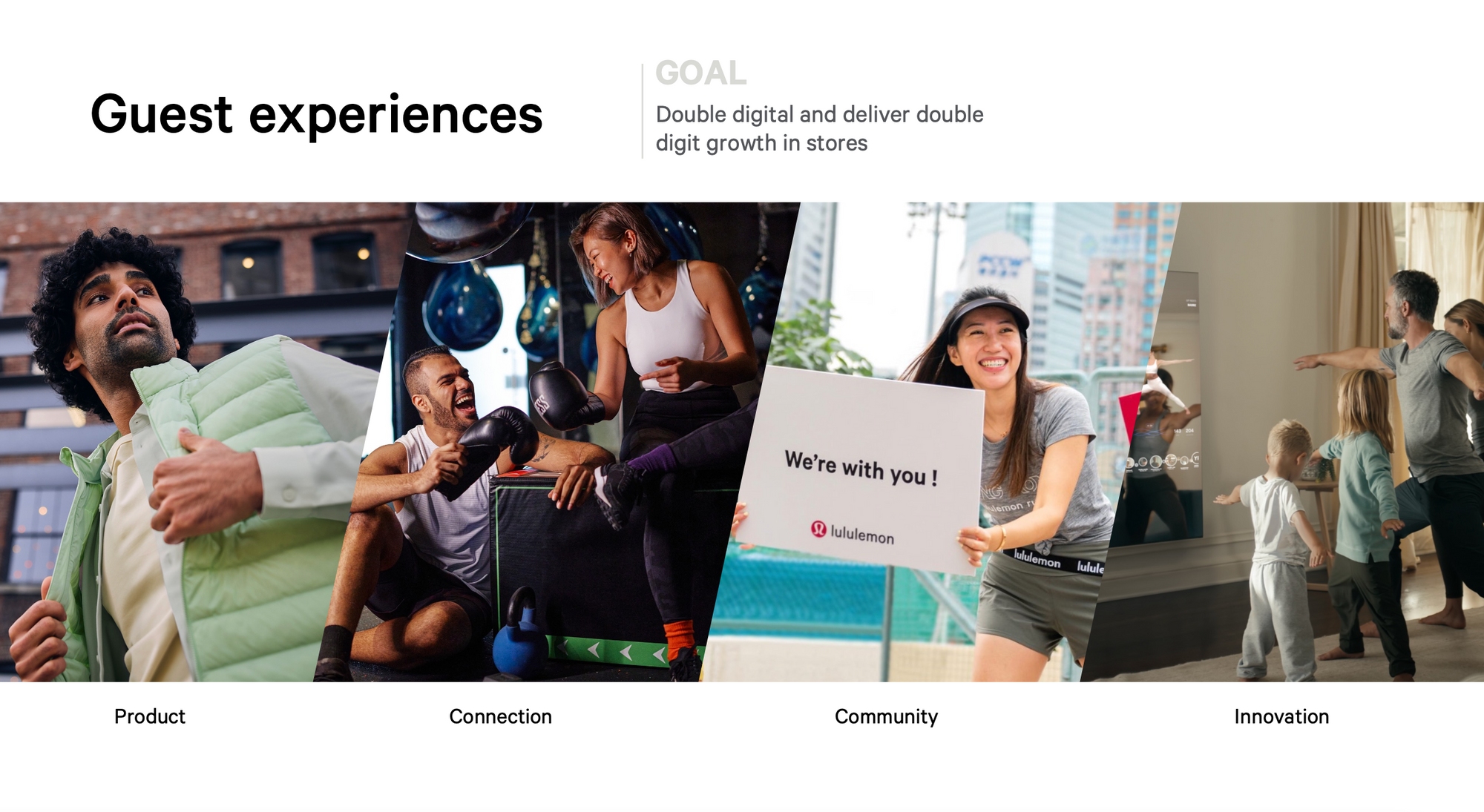

In order to 'sweat' the investment in their channels more efficiently, Lululemon are selecting to improve the customer experience of these consumer touch point so that they are better able to attract, retain and monetise (the holy trinity of customer-centricity strategies BTW) customers.

- Actively encourage more customers to shop online so that you are better able to capture and track valuable customer behaviour data to improve their allocations, marketing spend and the overall customer experience. It still greatly amuses us as to how few retailers and marketing professionals simply don't understand how this process works and actively ignore its immense value.

- Get more customers to shop directly [DTC] with Lululemon instead of choosing to buy products through a 3rd party retailer like Amazon by making the shopping experience so good they wouldn't dream of going anywhere else.

- Sell direct to customers in physical places other than the usual store channels - i.e. pop-ups, activations, festivals, gyms etc etc.

- Mine the customer data intentionally and relentlessly and use the insights to improve product innovation (many say they do it - few actually know how to do it properly).

To extend the Lululemon brand footprint the company plans to drive even more demand (considering all of the new categories the company plans to develop) in North America and Asia in particular.

- Lululemon estimate that the currently hold only 1% of total addressable market [TAM] of $650B in the new markets they are targeting. That's some juicy upside potential and a huge target for them to pick away at. Nothing motivates a team more than a consistent stream of small wins.

- Most of the existing Lululemon brand awareness and successful customer acquisition has been achieved through unaided word-of-mouth promotion; a strong, paid promotional push should amplify that somewhat.

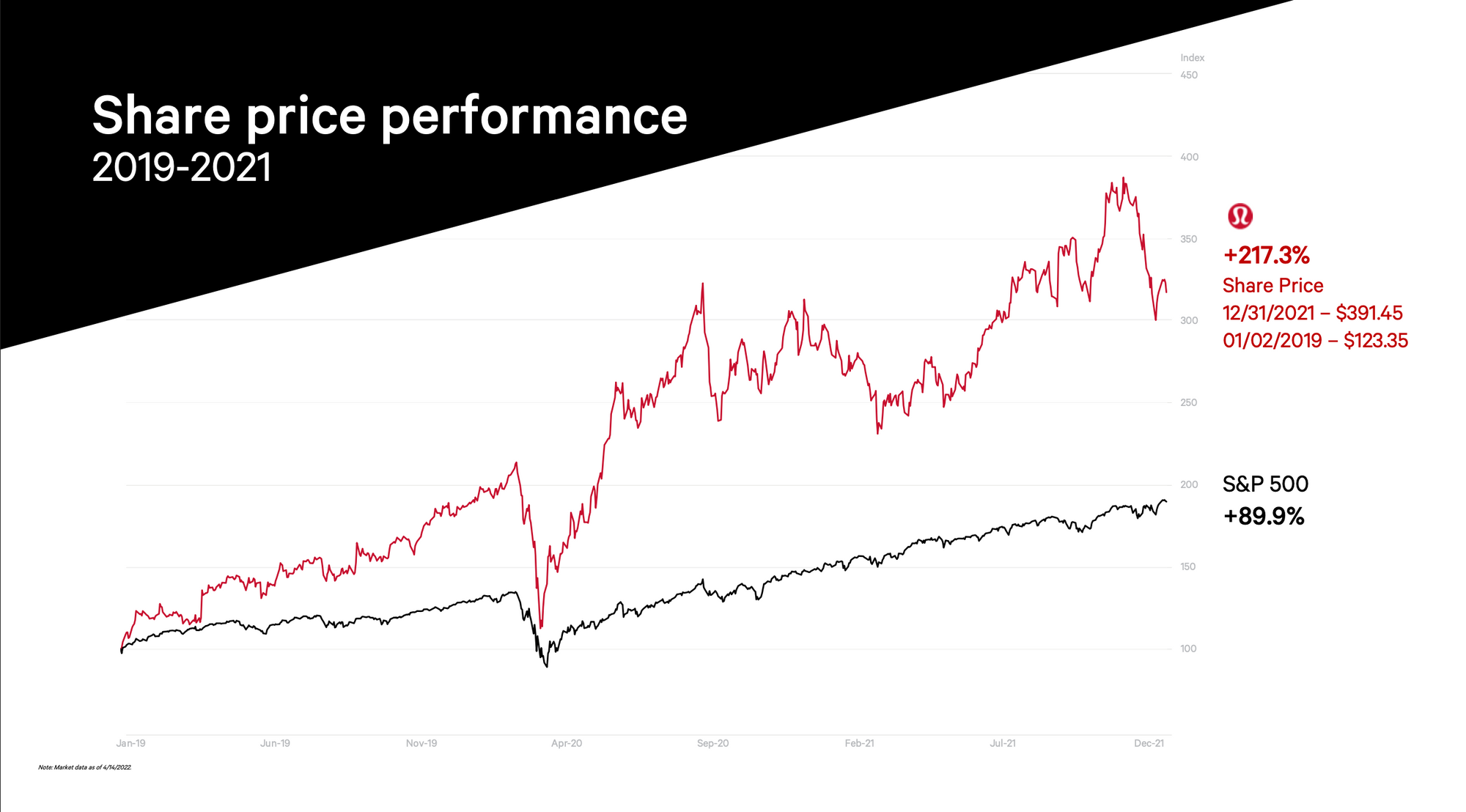

- They plan to build on their successful marketshare momentum - having gained more marketshare than any other athleisure brand in the world in the in the adult active apparel industry between 2019 - 2021. The idea is to intensify the push where there is already momentum rather than trying kindle new movement from a standing start.

- In selecting where to expend internationally, Lululemon have developed something called the Sweat Index. This tool critical evaluates a territory not just on its financial viability, but also on its 'customer viability', the estimated fit the brand will have with the culture of the potential customers and exercise communities that reside in a region. The Lululemon Sweat Index is presumably an algorithm that highlights markets where estimated CAC would be lowest, while at the same time projects where LTV would be most compelling for the company. This is smart retail science.

So what?

To the casual strategy observer the core of the Lululemon strategy is to simply advance the business by focusing resources and capacity on developing product, customers and brand.

There is nothing really too remarkable about this.

Most organisations with average management teams post similar sounding nonsense strategies to shareholders without taxing their thinking competency any more than is necessary.

The shrewdness of the Lululemon strategy is shown when you sit back and see the interconnected big picture of the thinking behind it.

Applying strengths to identified opportunity

Everywhere you look, Lululemon are focusing their strengths on areas of opportunity. Instead of spreading themselves thinly across a wide-variety of loosely defined targets (like you see all too often in bad strategy documents), they have a coordinated drive of action targeted at tight objectives.

Lululemon are masters of fabric innovation [link] that are impossible for competitors to replicate.

The company owns trademark and patent registrations for several of its products and fabrics.

Spotting a weakness in the kinds of comfort offered by the fabric used, as well as the garment construction methods, of existing incumbents in categories and segments that are outside of their traditional base; they have identified an opportunity where they can successful go in and disrupt the status quo of the marketplace.

This is the deeper thinking behind the #1 Double Men's strategic pillar.

Lululemon have proven over the years that they are very good at creating and managing communities of like-minded people. In fact it's rather enlightening that as a business they don't refer to their customers as customers; instead they are called 'guests'.

This should really tell you everything you need to know about how the brand relates to their customers and what kind of emotional connection they are trying to create with them.

You cannot own your guests; if you are offering them increasing amounts of value each time they pop around, chances are they'll hang around just a bit longer.

Lululemon customers are cherished and pampered and the #2 Double Digital strategic pillar is how they are going to leverage this core strength into the e-commerce space, as well as a creative smorgasbord of innovative new customer touch points, to build new relationships with guests.

By harnessing their ability to view every new market as culturally unique, as well as their endlessly flexible route-to-market options - Lululemon are taking that strength to new markets with the intention of building a unique relationship in each based on the needs of those communities.

This is not a cookie-cutter, mass globalisation approach that you normally see from large organisations.

In the #3 International Expansion strategic pillar, new guests will be welcomed in the fold and relationships built slowly.

Impact Agenda

The strategy is underpinned by a bigger idea - one that doesn't change depending on the challenges faced.

They call this bigger purpose statement their Impact Agenda which outlines a vision for the future of the entire fashion industry which is more human, contributing more to positive wellbeing and kinder to the planet.

Lululemon are putting their hands up as leaders in the fashion industry, pioneering a better way to do business considering the collective issues the industry is facing.

In closing

Doubling a 25-year old business in just 5 years...is a tough ask.

Inflationary pressures, a trade cold-war with China and continued economic and social fallout in the aftermath of the pandemic are all worrying headwinds that challenge even the most well-capitalised organisations.

Lululemon however have proven themselves to be rather resilient and agile under these conditions.

They have consistently grown their YoY earnings, have demonstrated that they have what it takes to actually implement strategy (rather than just making pretty slide decks that everyone 'loves'...and then ignores) and have worked hard to attract and retain the right talent to ensure that these successes continue into the future.

To us, their published strategy looks plausibly achievable within the timeframe projected.

What they have on their side - more than anything else - is a great brand coupled with a proven product-fit with a vibrant marketplace in North America. The sheer size of the market in the USA is just staggering when compared to that of South Africa - makes you wonder why on earth any business would even bother with wasting time appealing to South African consumers.

With such a powerful and compelling reputation for quality and excellence it's hard not to want to back them in their quest.

This case study also highlights just how unbelievable valuable a great brand and a viable market is in any growth strategy.

It's the magical lubricant that in many cases ensures that any envisages guiding principle of business development is achievable because it inspires collaboration and the imagination of staff and customers.

At US$376,99 a share (ten years ago you could pick up the counter for US$36.26 a share), but sitting at a P/E ratio of over 50 - there is a lot of optimism already priced into the stock.

For us, as an optional investment, it looks a little too rich right now, but there is no doubt that this is a quality business with some very savvy leadership strategically guiding the brand into the future.

Previous related articles on Cherryflava