If I were the Woolworths CEO...

The current state of affairs in the category is harrowing; the probable future looks downright disastrous.

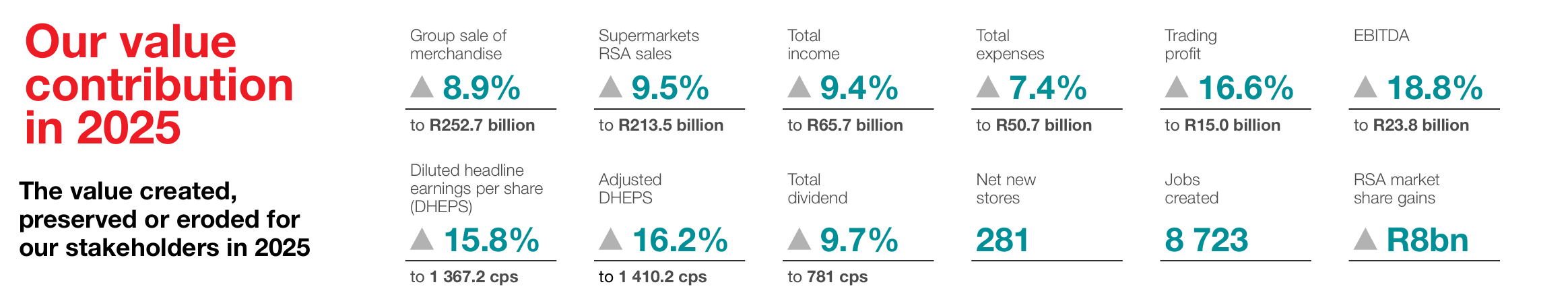

If I were the Woolworths CEO...I would be looking at the Shoprite 2025 Integrated Report with a fair amount of envy, as well as some concern.

Here's the image that would be burning a big hole in my face...

...and what I would be primarily thinking is: 'How on earth do we compete against this momentous monster?'

The task at hand is made even more daunting by the realisation that many of 'the monster's' long-term plays (UNIQ, Petshop, own brand products etc etc.) haven't even begun to generate proper traction in the market as yet.

The current state of affairs in the category is harrowing; the probable future looks downright disastrous.

And the issue is not just how successful the supermarket market leader is in generating revenue and profit, but how successful they have become in capturing customers at scale.

Not just capturing them on a per-purchase basis, but locking them into their powerful platform and managing to keep them there.

When the incentive for a customer to stay loyal to a diversified platform exceeds a competitor's ability to lure them away with an alternative offering; your customer acquisition costs (CAC) shoot through the roof and the quality of customer that you end up attracting from that expense remains substandard.

If that weren't enough, Shoprite / Checkers is just one of an increasing number of highly-capable competitors that are emerging (hier kom Koos Bekker BTW).

This is the complex problem that looms large here.

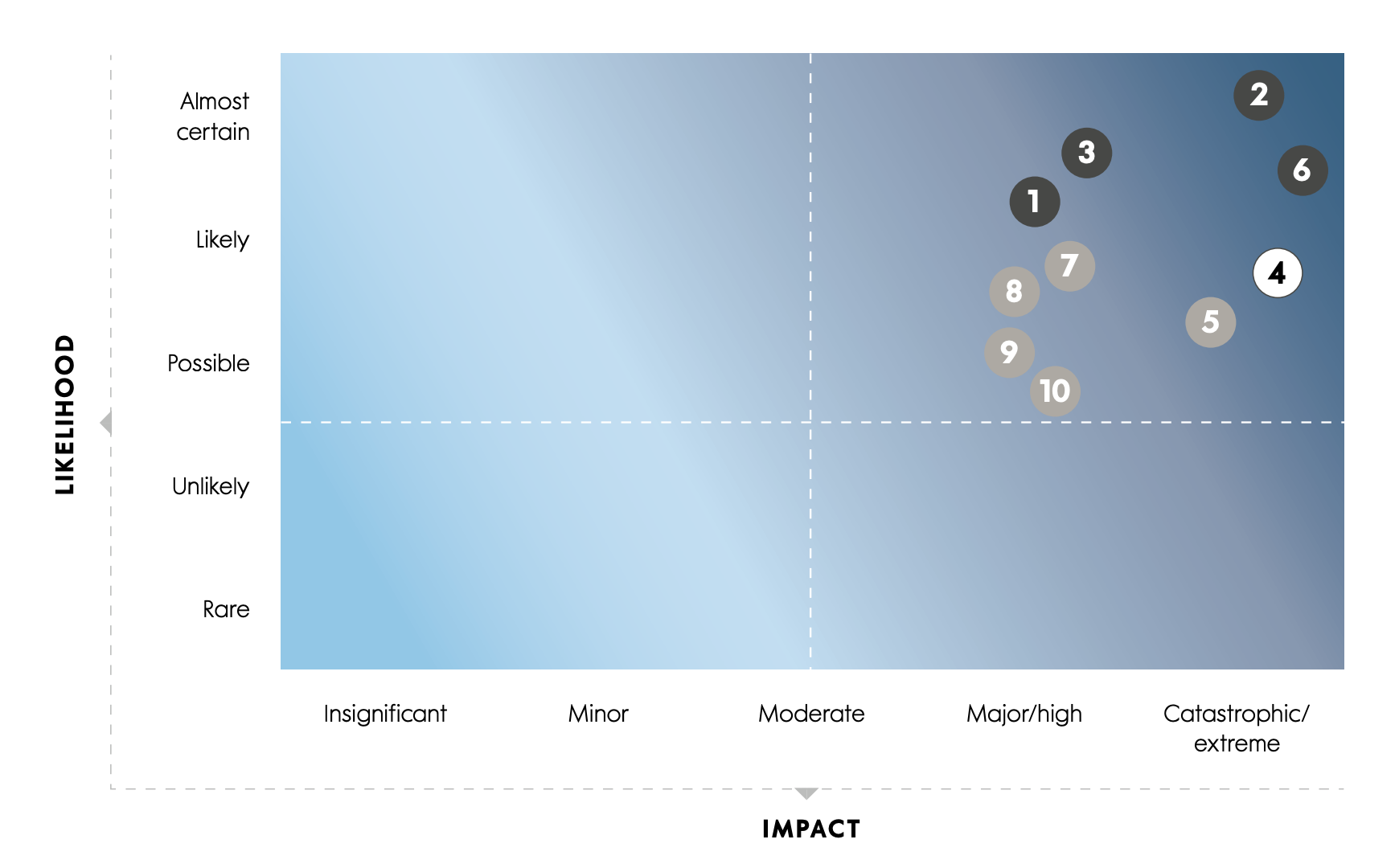

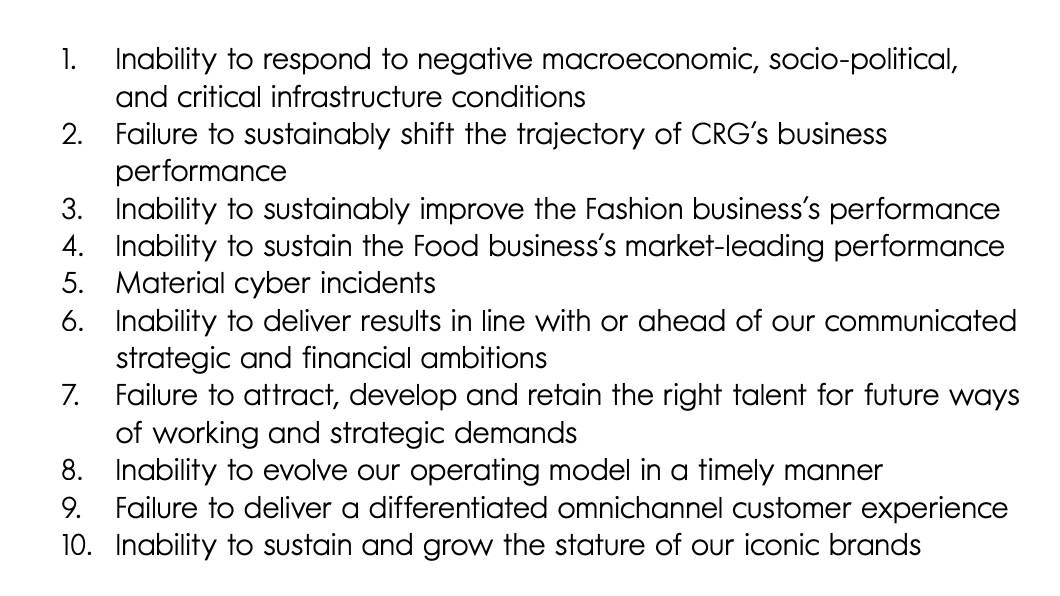

And from a systems-perspective it is exactly this 'complex customer problem' that is cascading into a plethora of related, interconnected risks for Woolworths:

Principle risks faced by Woolworths [source]

For now, the Woolies food business is performing okay, but Country Road and Fashion, Beauty and Home (FBH) are going backwards and serve as joint 'canaries in the coal mine' for them.

But in a careful and considered analysis of the Shoprite report versus the Woolworths report there appears to be a very clear difference in focus between the two companies...and that critical difference is in how they frame and regard 'the customer'.

For Shoprite, what appears to be the key in their model is that they are in the business of acquiring and keeping customers. They don't just use this construct, or these terms, as appropriate language to include in an annual report; they consider this as their strategic business intent.

Once they have a customer successfully signed up, they are able to deepen their relationship with that customer over time using technology and consistently nudging and offering them ongoing layers of value; right from one extreme, say, a can of baked beans...to a basic tee-shirt...to a microwave and more.

Woolworths on the other hand are very much focused on their brands, their sustainability credentials, maintaining the performance of their 'holy grail' food business (BTW it really does feel problematic to be actively using this metaphor to describe the food business, mainly because what you are effectively doing it separating it from the rest of the business and declaring it's current operational execution as untouchable. It's a bit like labelling one of your children as 'your favourite'. This is an extremely dangerous label and conceptual frame to be intentionally using).

In short:

- Shoprite is looking outward and building relationships for the long-term.

- Woolworths are looking internally and maintaining standards.

Woolworths are not doing anything particularly wrong, but on their current metaphorical trajectory there will just be fewer and fewer customers in the marketplace left to sell excellence to as time marches on.

So - if I were the Woolworths CEO... I would stop, clear the deck of all current strategic logic and invest some proper time in attempting to identify what the real problem is that needs to be solved.

Clearly the current approach is premised on executing a lot of important tightening and optimisation work that's being done on different parts of the business, which (don't get me wrong) is important, but there needs to be transparency and consensus on what the bigger issue is that is being largely ignored (or not being framed effectively enough as yet).

My suspicion is (and this might sound like a radical over-simplification) that the business has a problem with how it sees itself and who / what it is in service of. All of the parts are not coherently focused on the same thing and because of this misguided obsession with 'doing things right, rather than doing the right things', Woolworths will simply end up trying to continue to function in service of a diminishing pool of poor-quality customers.

Time is critical here too.

Already on the horizon there are faint signals of a potential severe disruption, that if the scenario plays out as it currently is projected (at least the one that we can see unfolding from our vantage point), will have a catastrophic commercial impact on that 'holy grail' food business. And judging by the map of known risks that the company is cognisant of, this particular scenario is going to come as a nasty surprise.

Metaphors matter because they offer a frame within which choices are ultimately made. And the metaphors Woolworths are currently using as a lens to view the contextual landscape are constricting their ability to respond effectively to the known and unknown risks that they face.

The solution to their growth challenge may just start with an intentional recalibration of these mechanisms....that is, if I were the Woolworths CEO.