Mayu Wars and the undercover fight for the South African consumer

Patterns suggest that lots of markets in South Africa are opening up as big companies continue to make silly mistakes.

Weird things are happening on grocery shelves in South Africa.

Over the last 18 months or so, iconic brands like Peck's, Redro (both owned by PepsiCo) and Hellmann's Mayonnaise (owned by Unilever) have made the decision to stop selling their products in South Africa; only for them to then return a while later via an agreement (in both cases) with Pick n Pay.

The reason for the discontinuation? 'Inflationary pressures and escalating supply chain expenses', which have made doing business in South Africa unprofitable (that's the official version of the story at least).

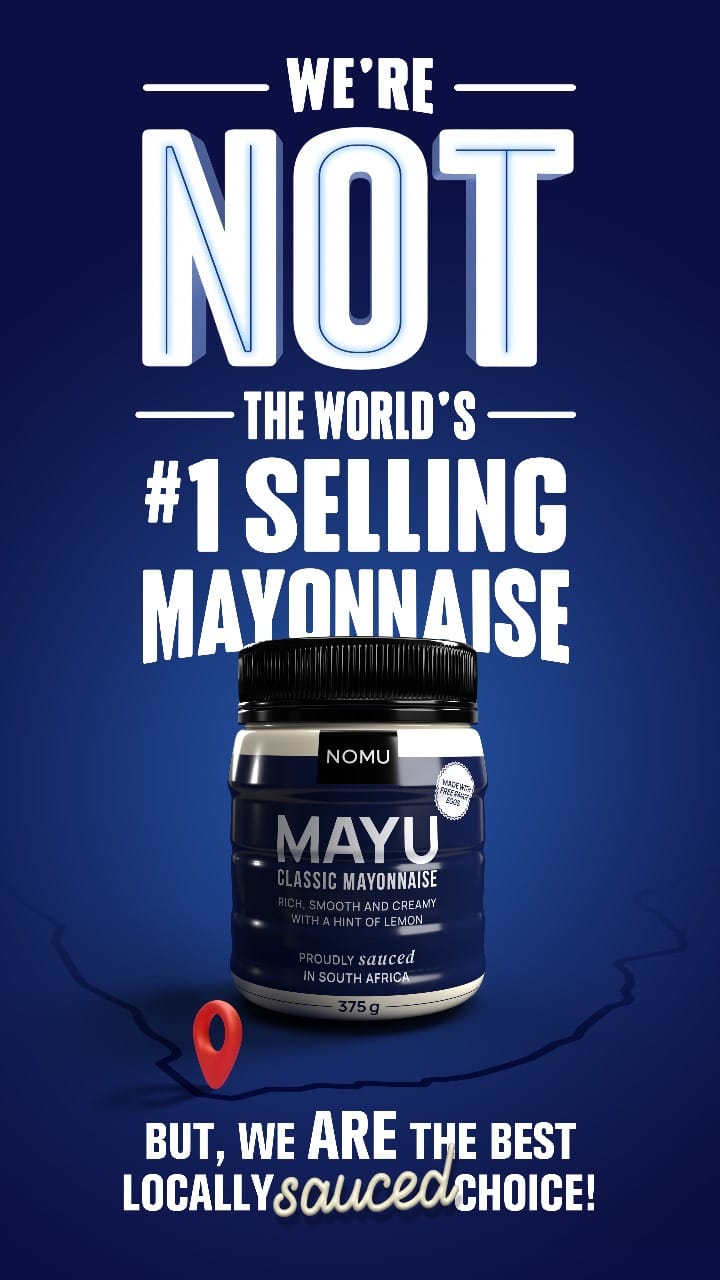

In the vacuum of the mayonnaise crisis, local brand NOMU swiftly filled the opportunity with a great product that they created in record time, MAYU, which has been a great commercial success for them.

Now that Hellmann's is back in SA (albeit reluctantly) the competitive mayonnaise arena is heating up again. NOMU; being the small, nimble operator that it is, is understandably not taking this re-entry lying down.

BTW - in Russia when Western brands pulled out of the territory because of the Russian invasion of Ukraine, a flurry of copycat fake brands quickly replaced the official ones thanks to the opportunity that this vacuum gave them.

The question is though - what the fuck is going on at these companies that they see the only possible future in the country for their brands is an absence of their involvement?

Why would brands that have spent decades and decades building up equity and marketshare in an important, growing region simply withdraw support entirely just because of 'short-term inflationary pressures'?

The reason we suspect - sadly - is because the people in charge of these decisions are making them using a perspective which is limited in the time horizon used to inform it.

What that means is that short-term gains are taking precedence over long-term opportunity.

Here....here's the evidence to back up that statement:

PepsiCo's Chairman and CEO, Ramon Laguarta, and CFO, Hugh Johnston, discussed the company's strategies and outlook for 2024 during their 2023 Third Quarter Earnings Question-and-Answer Session. Amidst global inflation concerns, the executives highlighted volume and margin optimization strategies, changing consumer trends, and the company's continued focus on cost reduction and productivity. PepsiCo, known for its track record of meeting or beating consensus for 55 consecutive quarters, provided its 2024 guidance earlier than usual, citing increased visibility into commodity inflation.

According to InvestingPro data, PepsiCo has a market cap of $225.46B USD and has seen a revenue growth of 10.11% in the last twelve months ending in Q2 2023. The company's gross profit for the same period stood at $48.39B USD, demonstrating a healthy profit margin of 53.69%.

Yes - PepsiCo are being aggressive in pruning unprofitable business. In their own words the company's focus is on automation, digitalization, and precision in decision-making. Data is informing their choices far more than real strategic thinking.

In the short-term this will make their numbers that are proudly presented to shareholders look good, but what about the future?

Africa as a commercial region holds a lot of growth opportunities for brands, but the road to that future is not a straight line. The reality is that brands that pull out now will need to come back in at a later stage and build up again without critical momentum.

Getting back in will most likely be far more expensive than just riding out the storm. But big companies like PepsiCo and Unilever are not equipped to deal with the realities of complex growth over time - they are addicted to 'short-termism', an affliction that will most certainly come back to bite them.

In that time, operators that are able to make building a brand in South Africa work - like NOMU - are only going to get stronger.

This is certainly not the last time that a global CFO's over-involvement in strategy opens up a category for local operators to capitalise on in South Africa.

If you are sitting in plush offices in Manhattan it's unlikely that you're going to make a great strategic decision involving a region you know little about, just by looking at data on a screen. Just think of all of the brands in South Africa where the same risk might also exist.

Advice for local CMOs?

Be ready to pounce on opportunities this this kind of problematic thinking opens up in the local marketplace. As more global companies put blind faith into data, AI, and other technologies that can only present 'insights' based on historical datasets rather than forward-orientated creative thinking - gaps will open up.

That's what makes a market - big players become more arrogant and make mistakes as a result, which is where smaller players can capture some marketshare for themselves. Thanks very much.

Fake brands replace exited Western brands in Russia: