Is a DAO the future of company ownership?

A DAO is an internet community with a shared bank account.

DAO is an acronym that stands for a 'decentralized autonomous organization' - and yes, it runs on blockchain technology and more and more of them are being started everyday.

DAOs are typically started as a kind of VC fund investment, or by a group of people pooling their resources together to buy NFT art or other collectables.

DAOs can come in all shapes and structures, but simply put, “a DAO is an internet community with a shared bank account,” Cooper Turley, an investor and builder of several popular DAOs, tells CNBC Make It.

“Basically, a small group of people come together to form a chat group, and then they decide to pull capital together, [typically] using an Ethereum wallet,” Turley says. From there, they decide how to fund their DAO’s mission collectively, he says.

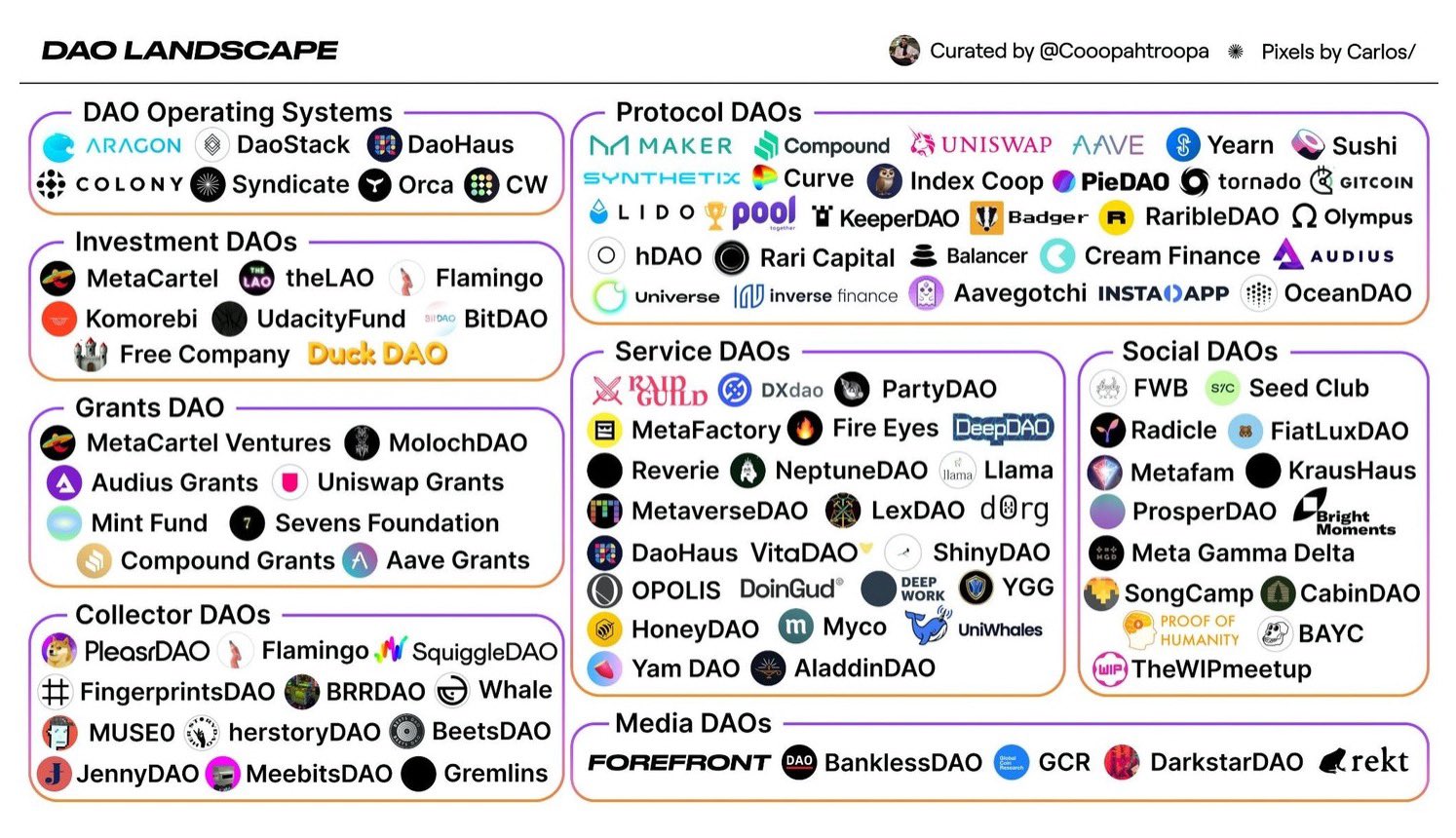

Many DAOs fall into one of two general buckets: Those that manage open source, blockchain-based projects together and those that make investments. They can act similar to limited liability companies (LLCs), VC firms or investment firms, like PleasrDAO.

The specifics of each DAO, including its type, structure, rules and governance, depend on the group and its goals. - via

Here are a few examples of well-known DAOs:

- The PleasrDAO collects various NFTs and invests in other assets.

- The HerStory DAO collects and funds projects by Black women and non-binary artists.

- The Komorebi Collective DAO funds women and non-binary crypto founders.

- The Friends with Benefits DAO is an exclusive social club which you pay to enter.

- The MetaCartel Venture DAO is a for-profit business that invests in early stage decentralized applications.

As is usually the case with crypto and blockchain-leveraged opportunities these days - the price of participation is going up. Big 'money' is chasing the hype and in many cases this is simply creating yet another exclusive club of billionaire that have private access to a new toy.

'$FWB’s value soared after Andreessen Horowitz invested $5m and Li Jin put in $10m into the community. It’s a “bull market”, in the words of the white shirt who prices the artist out of bohemia. One might question the very “decentralization” of a community’s governance that both establishes community rules and regulates its own currency, as if the president and the Federal Reserve were combined.

Most DAO evangelists will tell you that DAOs allocate voting power on community decisions to their members. But FWB, like most DAOs, grants one vote per token, instead of one vote per person. This is profoundly undemocratic. While $FWB tokens are also granted to members whose comments on Discord receive the most engagement, like gaining “likes” on Facebook, any investor can buy up their share of votes at any moment with a click.' - via

Look, big-liberal swinging dick NFT stories aside, the underlying idea of a DAO is very interesting.

Right now yes, the space is filled with Silicone valley pricks who are out to make serious bank from a very steep hype cycle, but ultimately the idea that a global company can be incorporated without the use of traditional legal formality and all the hassle and red tape that it normally takes, is hugely useful.

The construct of how we can achieve ownership of an asset is changing thanks to blockchain technology. At this early stage it's all still a bit hazy as to how normal people can leverage the opportunity to make their lives less controlled, but the DAO framework is certainly one that we will be exploring a bit more now that it's on our radar.